Programmatic Advertising Grows Up: Marketers Tap Audience Data to Compete in Hot Industry Verticals, Channels and Emerging Markets

The first four months of 2014 show dramatic changes in marketer spend and data-driven strategies in new markets and channels, according to the new Advertising Intelligence Index from Turn (turn.com), the marketing software and analytics platform. As brands and agencies increasingly search for customers across the media landscape, the amped-up real-time bidding (RTB) marketplace is changing rapidly beyond traditional display advertising.

The report (accessed at turn.li/2014mayinsights) shows mature markets such as financial services and travel stabilising at high levels of competition and spend – with much less volatility – as marketers plan better for data-driven budget allocation.

Programmatic Ad Spending Up Across All Channels; eCPM Prices Increase Due To Stiffer Competition For Inventory http://t.co/nMXRVn6JW4

— Turn Inc. (@TurnPlatform) June 1, 2014

The data also indicates advertisers are investing heavily in emerging regions and channels; for example, competition and spend surged in mobile advertising across Asia and Europe.

The Turn @TurnPlatform research shows data-driven marketing trends worldwide from January through April 2014, compared with the same period in 2013.

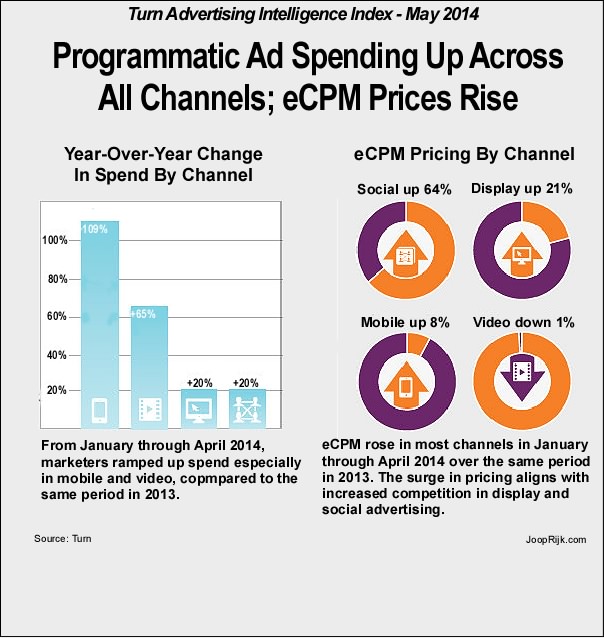

Advertisers sold on the benefits of display ads continue to ramp up budgets, while getting smarter about harnessing data and targeting spending to find customers across all other channels. The report notes a massive increase in how much advertisers from all industry verticals allocated to mobile, video, display, and social channels from January through April 2014 vs. 2013:

Marketer spend on mobile was up 109%

- Video ad spending increased 65%

- Display, which has become a more mature channel globally, was still up 20%

- Social advertising budgets rose 20%

The global analysis found that marketers are paying more to reach their target customers as competition increases, with eCPM (effective cost-per-thousand impressions) for social, display, and mobile advertising increasing year-over-year from January through April 2014:

Social advertising eCPM soared 64%

- Display eCPM was up 21%

- Mobile eCPM rose 8%

- Video eCPM was essentially flat, decreasing 1%, as an increase in inventory suppressed pricing

“Spend and competition are increasing in mature markets, leading to smarter data-driven budget allocation this year,” said Pierre Naggar, Managing Director EMEA, Turn. “Brands and agencies are using sophisticated audience-first strategies to drive planning for programmatic advertising, turning insights into an advantage against the competition.”

In Europe, we’ve seen the following trends for January through April 2014 versus the same period in 2013:

- Compared to 2013, display was less competitive and more volatile.

- Europe is catching up to the U.S. for mobile, only lagging by about two months, with much higher levels of competition this year.

- Social also saw big increases in competition and is maturing rapidly.

- Video saw more activity during this period, but overall it’s still a volatile market.

The report is based on an analysis of data from the Turn platform, which every day makes over 100 billion data-driven advertising decisions, analyses over 1.5 billion anonymous customer attributes, and provides instant access to billions of digital ad impressions – resulting in an unmatched ability to provide game-changing insights.

Turn provides three real-time marketing applications: Audience Suite, an enterprise data management and audience planning platform; Campaign Suite, a digital media execution platform for video, mobile, social, and display advertising; and DataMine Analytics, a data exploration, optimisation and warehousing solution purpose-built for marketers. Turn works with the world’s top brands, agencies and trading desks, including Accuen, Aegis, Dell, Experian, Microsoft, OMD, Sky, Sojern, Thomas Cook, Toyota, and VivaKi.