With the increased use of mobile applications amongst consumers, Chris Hill, SVP of Marketing at Mobidia, highlights how marketers can utilise valuable insights into mobile app usage to determine the level of engagement with their users and that of their competitors.

In the past looking at the number of downloads for mobile apps was enough to determine whether an app was successful; however this isn’t the case nowadays, with so many apps available and so many being downloaded, consumers may download apps that they never or seldom use. So the brand and app developers need to know whether its users are fully engaged with the app and the brand.

Monitoring key factors such as: the number of active users, the number of sessions and the amount of time spent on the app, all help to distinguish the level of actual engagement. Using such sets of data can help marketers make smarter and better marketing decisions going forward.

Active users

A great indication of engagement and app usage is monthly, weekly and daily active users – these are typically defined by the number of people that use the app at least once in the time period. Such data allows for marketers to determine how many individuals are actively using the app over a given period of time and the pattern in which it’s being used. This can then be compared with competitor’s usage to see whether they have a higher or lower level of engagement and, if necessary, arm them with the knowledge to implement strategies to rectify any disparity.

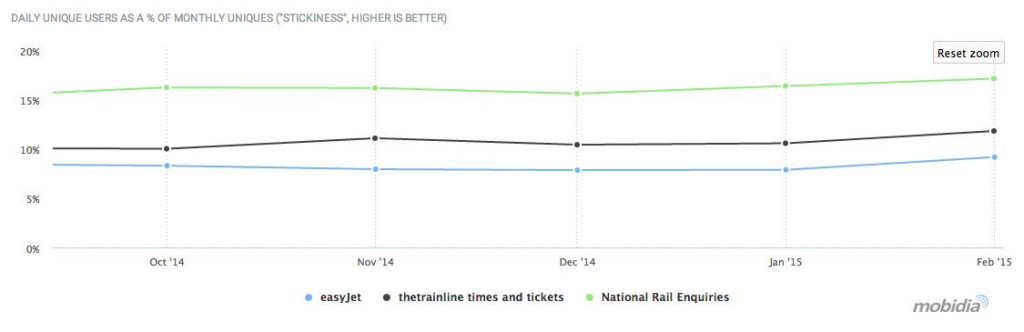

For example, data from Mobidia’s global mega-panel of millions of users shows that amongst Android travel app users, the National Rail app has the highest level of daily unique users, compared to trainline and EasyJet. App usage data like this highlights that users of the National Rail app are more engaged with the brand and are using it as a quick and easy way to check train times on a daily basis.

Minutes of use

Identifying the amount of time and minutes of use on various mobile apps gives an increased sense of the level of engagement, as it highlights how long people are actually interacting with the app and not just downloading an app by using it once.

Of course, the most appropriate metric of measurement to use may depend on the type of app that is being analysed. Taxi booking apps for example are likely to be looking for shorter periods of time spent on the app, but they would love to see more sessions – indicating that people are heavily using their services. However, publishers of content app such as news apps are looking for both – lots of sessions and evidence that people are using them for longer periods of time.

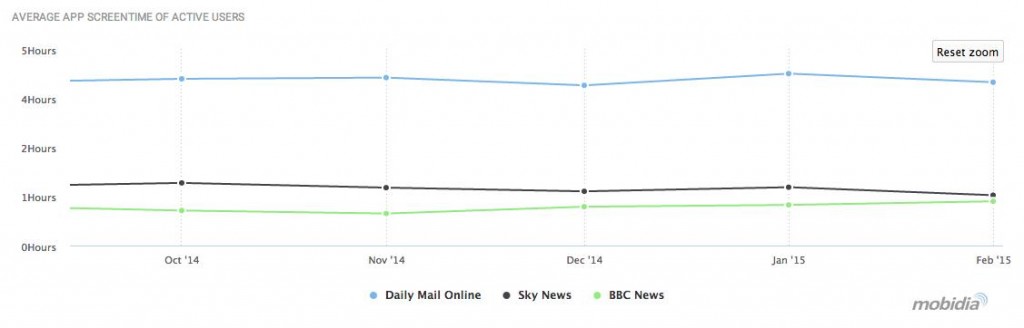

Recent data from Mobidia illustrates this point by showing users of the Mail Online app on Android devices having the highest average app screen time, compared to both Sky News and BBC News. Take-aways from this data might be that Mail Online users are more likely to read entire articles, whereas Sky News and BBC News users are more likely to just scan the headlines. Naturally for advertisers such data could be of great interest as it means that an in-app advert in the Mail Online could mean more exposure time of their ads to readers.

The length of time spent in an app depends on what the user is looking for from the app, so if they want to be able to book a hotel or look at something quickly, a shorter time per visit might be better and long periods may indicate faults in the app design. Therefore identifying that your app is taking longer to use might highlight the need for changes to be made to improve user experiences and engagement.

Global data set

The app economy is global, particularly amongst gaming, social messaging and video sectors. With this in mind, marketers and owners of apps with a global reach should look at engagement using a global platform to compare usage between different countries and against competitive brands. Many times the competitive dynamics vary greatly in different countries for these app categories.

The intelligence that can be derived from mobile app usage data is becoming a key focal point for brands and marketers globally, as it is one of the most actionable ways of identifying the true level of engagement of a mobile app. These valuable insights will fundamentally put brands and marketers in a stronger position to make smarter marketing decisions, which will help grow and improve both their mobile app usage, as well as the brand presence in the market – an important element in today’s intensely competitive landscape.

Chris Hill, SVP of Marketing at Mobidia